Life Insurance through Super is not always cheaper: study.

Many of us opt for default life insurance through our Super because it’s easy and cheap

It is easy - many Australians don’t even know they have life insurance through their Super it’s that easy - though is it always cheaper?

Key Highlights

- Many of us assume that life insurance and TPD is cheaper through Superannuation than purchasing life insurance and TDP through a retail policy.

- However, for a variety of reasons, this is often not the case and life insurance and TPD can cost more through Superannuation than through a retail policy.

- Possibly surprisingly, this is also true of industry funds such as Australian Super and Cbus Super.

What are group or bulk policies?

Life insurance and TPD through Superannuation is provided by what are known as group or bulk policies

These are essentially, one-size-fits-all policies, designed to insure large numbers of members of a Super fund.

Superannuation funds therefore do not individually insure members by default (though you can get a direct, retail policy paid through your Superannuation).

Why aren’t group policies less expensive for members?

The benefit of group policies for Superannuation funds is that they’re a simple purchase, though this doesn’t necessarily translate to cost savings for all Superannuation members as these group policies subsidise all members including older members and smokers.

The rising cost of premiums as a result of rising claims means that these policies are not as inexpensive for Superannuation funds as you might have thought.

Based on research by Insurance Watch, low cost life insurance premiums thrugh Superannuation are increasingly a “myth”.

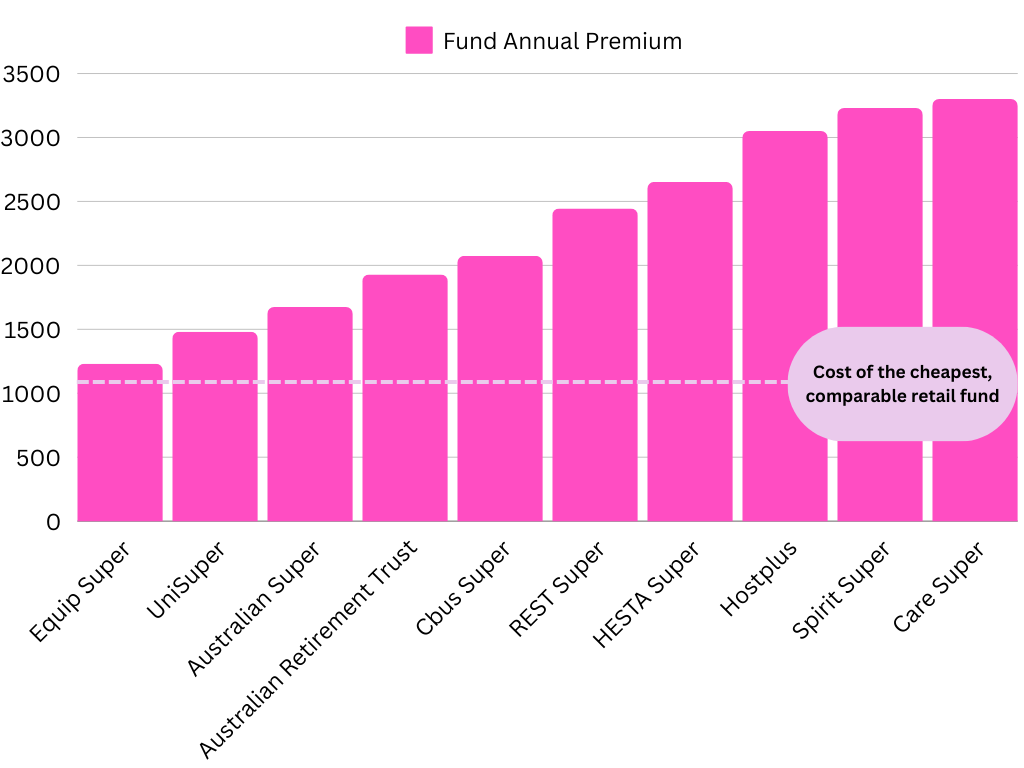

You can see the costs of Superannuation life insurance premiums here.

A 2023 study into Superannuation premiums vs retail life insurance premiums

Insurance Watch undertook a valuable 2023 study into the costs of life insurance premiums through Superannuation vs the cheapest comprable retail life insurer.

To do this, they examined the relative policies of a 45-year-old male:

- Non-smoker

- Accountant

- Living in Victoria, Australia in 2023

The cost of the cheapest, comparable retail policy was an annual premium of $1,018.

The study found that all 10 industry Superannuation funds had more expensive premiums than the retail life insurer.

The study compared the 10 largest Australian industry Superannuation funds:

- Australian Super: $1,674

- Australian Retirement Trust: $1,929

- REST Super: $2,444

- HostPlus: $3,050

- HESTA Super: $2,652

- Cbus Super: $2,074

- UniSuper: $1,480

- Spirit Super: $3,230

- Care Super: $3,300

- Equip Super: $1,230

(You can see the member numbers of Australian Superannuation funds here.)

At the bottom end of the scale, the annual premium difference between the cheapest retail life insurance policy and the cheapest policy from one of the compared Superannuation funds was $212.00.

However, at the top end of the comparison, the same person was paying an additional $2,282 per annum: more than three times (3x) the cost of the retail policy.

Of course, this is just one example and everyone’s circumstances are different.

This is general advice only, though you can easily determine if you are paying more for life insurance directly through your Superannuation: and if you are, there is no need to switch your Superannuation.

Just the provider of your Life Insurance which can still be paid through your Superannuation.

Conclusion

It isn’t difficult to work out if you are paying more for life insurance and TPD through your Superannuation than if you had a direct, retail policy.